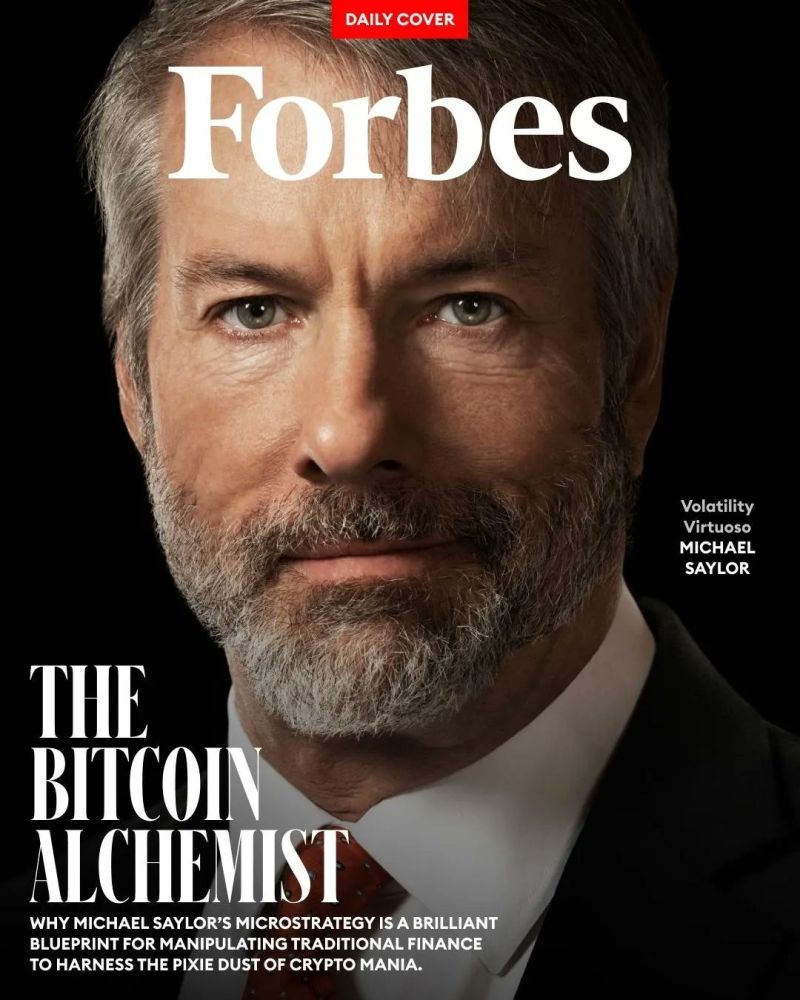

In the rapidly evolving world of cryptocurrency and innovative finance, few stories have captured the imagination—and concern—of market participants quite like Michael Saylor’s audacious strategy with MicroStrategy. As someone who’s been closely following and writing about this phenomenon, I believe it’s essential to break down what Saylor is doing and why it might be the most brilliant and dangerous trade of all time.

In my view, Saylor and MicroStrategy aren’t simply betting on Bitcoin—they’re orchestrating a multi-layered financial engineering masterpiece that leverages both market dynamics and debt strategies in a way that could upend the crypto ecosystem. Let’s delve into the mechanics of the strategy and explore its potential risks.

At first glance, MicroStrategy’s actions might appear to be a straightforward buy-and-hold strategy in Bitcoin. However, Saylor’s approach is much more nuanced. Instead of merely accumulating Bitcoin, the company is effectively executing a leveraged bet:

- Step 1: Borrow dollars—essentially shorting the dollar.

- Step 2: Use that capital to buy Bitcoin—going long on the digital asset.

This method means that MicroStrategy’s stock is inherently more volatile than Bitcoin itself, amplifying both potential gains and losses. It’s not simply about riding Bitcoin’s upward trend but about harnessing leverage to magnify exposure—a double-edged sword in volatile markets.

One of the most intriguing—and arguably risky—aspects of this strategy is what I call the “infinite money glitch.” Saylor has tapped into a loophole that allows MicroStrategy to generate capital seemingly without end:

- Stock Premium: MicroStrategy’s stock trades at a substantial premium to its net asset value (NAV).

- Capital Recycling: By selling stock at these inflated valuations, the company raises billions of dollars. This capital is then funneled back into buying more Bitcoin.

As long as the market continues to value MicroStrategy’s stock at these high levels, this cycle of leveraging stock sales to acquire more Bitcoin can continue indefinitely. It’s a self-reinforcing mechanism that hinges entirely on sustained market confidence.

A cornerstone of this financial engineering feat is the use of convertible bonds. Since 2020, MicroStrategy has issued billions in convertible debt, including:

- $650 million (0.750%) due 2025

- $1.05 billion (0%) due 2027

- $800 million (0.625%) due 2030

- $1.01 billion (0.625%) due 2028

- $700 million (2.25%) due 2032

- $3 billion (0%) due 2029

With over $7.21 billion in debt—much of it secured at near-zero interest rates—MicroStrategy’s debt structure minimizes immediate financial risk, at least on paper. These bonds have far-off liquidation triggers, allowing the company to continue its Bitcoin accumulation with relatively low immediate pressure from debt repayments.

While the mechanics of Saylor’s strategy are impressive on their own, they have also created a new playground for hedge funds. Here’s how:

- Convertible Bond Arbitrage: Hedge funds are quick to capitalize on the favorable conditions created by these convertible bonds.

- Hedging Exposure: They can hedge their bond positions using MicroStrategy’s stock or trading options.

- Volatility Play: The implied volatility from the convertible instruments (~60%) is significantly lower than the realized volatility of MicroStrategy’s stock (~200%). This disparity offers an enticing opportunity for hedge funds to trade the volatility spread for substantial profits.

In essence, while Saylor might be selling what appears to be “cheap volatility,” hedge funds are positioned to extract value from the differences between the bond’s theoretical risk and the stock’s actual behavior. This dynamic adds another layer of complexity and risk to the overall strategy.

Perhaps the most concerning aspect of Saylor’s strategy is its potential to create systemic risk for the broader cryptocurrency market. By intertwining MicroStrategy’s fate so closely with Bitcoin’s success, Saylor has inadvertently made the company a cornerstone of Bitcoin’s market structure. Should the strategy falter—whether due to a stock price collapse, rising volatility, or other external shocks—the repercussions could ripple throughout the crypto space:

- Narrative Undermined: A failure could severely damage the narrative of Bitcoin as a safe haven and a revolutionary asset.

- Liquidity Issues: Market confidence in Bitcoin could wane, potentially affecting liquidity.

- Trust Erosion: The credibility of Bitcoin as an investment could take a significant hit if one of its most vocal proponents and largest institutional buyers faces a collapse.

Is this Brilliant or Reckless?

There’s no denying that Michael Saylor’s approach is a marvel of financial engineering—a strategy that leverages cheap debt, exploits market premiums, and recycles capital in an almost self-sustaining loop. It’s brilliant in its ambition and complexity. However, brilliance in the world of high-stakes finance often walks hand-in-hand with recklessness.

While Saylor’s bet on Bitcoin could yield unprecedented rewards if market conditions remain favorable, it also leaves MicroStrategy—and by extension, a significant part of the crypto ecosystem—exposed to massive risks. The company’s highly leveraged position means that any significant downturn in Bitcoin or a loss of confidence in its stock could trigger a domino effect with far-reaching implications.

At Farrington Capital Group, we love innovation in financial strategy is essential, but it must be tempered with caution. Saylor’s maneuver is a fascinating case study in leveraging market dynamics, but it’s a reminder that even the most ingenious trades can turn into ticking time bombs if market sentiment shifts.

Brilliant innovation or reckless overextension? Only time will tell. In the meantime, investors and market observers alike would do well to keep a close eye on how this high-stakes bet unfolds—and consider the broader implications for the financial and crypto markets.

No responses yet